The second part to the survey was about "life abroad". Slightly more than half of participants felt that the local's had a better quality of life than in the US, with slightly less than a quarter feeling it was about the same and only 20% feeling that locals were worse off than the US.

|

| 235 participants by local quality of life |

|

| 235 participants by their quality of life |

Their reasons for moving abroad were also very interesting. Because there was an "other" column in which people could supply their own answers, I had to correct many entries to "other", as I'll show below the graph. It's clear that I should have listed "Education" as one of the choices.

Fully one-third of the people choosing to move abroad did so for adventure. Contrary to what many people back in the US believe, only 12% did so to get away from US politics. This is in line with other surveys showing few people moving away due to politics. As expected, many people (17%) moved abroad for love, while 10% did so to seek work and 8% did so for their current job.

|

| 235 participants by reasons for moving abroad |

- 14 responses — Education

- 3 responses — All of the above

- 2 responses — Health care

- 2 responses — Never lived in US

- 1 response — Adventure, then history, now love. I wouldn't be in the UK if not for love.

- 1 response — Adventure, work, and to avoid paying US taxes (Foreign earned income exclusion)

- 1 response — Better cycling infrastructure and urban design

- 1 response — Better life

- 1 response — Better long-term opportunities

- 1 response — Escape US lifestyle

- 1 response — Humanitarian work

- 1 response — Husband accepted job abroad, I followed.

- 1 response — I had a good opportunity fall in my lap

- 1 response — I was born an expat.

- 1 response — I'm a lifelong expat. First moved to China at age 7. For me living abroad is more comfortable than living in the states.

- 1 response — Love Europe

- 1 response — Love and Wanderlust

- 1 response — Love of France

- 1 response — My parents moved me when i was 14 and never wanted to go back

- 1 response — No interest in US

- 1 response — To continue living abroad in one section of the country until I could hop to the one I wanted to be in

- 1 response — To make money

- 1 response — canadian mother moved me to canada

- 1 response — child dependant

- 1 response — i was here

- 1 response — spent most of my life abroad in other countries, came here to study

- 1 response — why not

- 1 response — with parents

- 1 response — work and way of life

On a side note, Excel's pivot tables did not like a numeric year as a data label. Hard-core Excel users know what I'm talking about.

|

| 224 participants by year left |

For whether people planned to return to the US, they were fairly evenly divided between "yes", "no", and undecided. Of those who were decided, they tended to prefer not returning to the US.

|

| 234 participants by "plan to return to the US" |

Generally, the largest group of participants reported that they could speak the local language fluently, with poorly coming in second (Note: I now know why so many people number their answers when creating surveys: it's much easier to make the answers sort properly in Excel).

|

| 235 participants on ability to speak local language |

When I corrected for those living in countries for which English was not the native language (the UK, Canada, Australia and New Zealand), the largest group reported that they could speak the local language poorly:

|

| 235 participants on ability to speak the local language in primarily non-English speaking countries |

Regarding the number of countries participants have lived in, the text stated "this includes your home country." I perhaps could have been more clear as 10 people listed 1 country. Only one of those stated they were born on foreign soil, so the other 9 have presumably lived in the US and one other country.

|

| 230 participants by countries lived in |

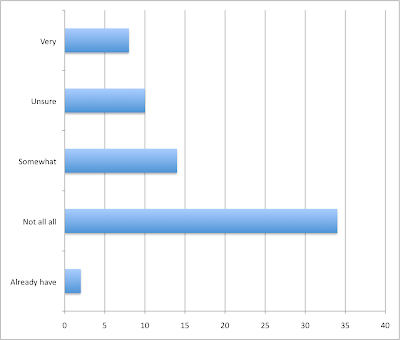

Next, we had two questions about whether you were likely to take the citizenship of another country and another on whether you were likely to give up your US citizenship.

For taking another citizenship, people were clearly interested in this, with only 47 out of 232 answering "not at all".

|

| 232 participants by likelihood of taking another citizenship |

|

| 232 participants by likelihood of giving up US citizenship |

Though income levels won't be covered until a later post, I did some breakdowns by income levels. As you can see, for those earning $70K US or more, they're not more likely to give up their US citizenship.

|

| Individuals earning more than $70K US by likelihood of giving up their US citizenship |

|

| Individuals earning more than $90K US by likelihood of giving up their US citizenship |

|

| Individuals earning more than $100K US by likelihood of giving up their US citizenship |

That's interesting, because if it's representative, it puts the lie to the idea that it's the wealthy planning on casting off their US citizenship. Also, there didn't appear to be a correlation with education level and likelihood of giving up their US citizenship. This really looks like an "across the board" phenomenon.

The vast majority of Americans abroad will not owe US taxes due to the FEIE, tax treaties, housing exemptions, and so on. It's not taxes people are complaining about. It's the complexity of US tax law for expatriates, the time and expense of filing returns on which we owe no money and the severe financial and legal penalties involved in making mistakes on our forms — penalties that people living in the US do not suffer from.

- A punitive tax system which provides me with much anxiety and no benefit.

- Avoid the stress and pain of dealing with the IRS

- If I did not agree with the long-term direction of the U.S. Cost of compliance, limited opportunities to save for retirement in the host country,

- US politics. The corporations have more control over my representatives than the voters do.

- I want EU citizenship, can't have both. Also, taxes. I'm not about to give the US a chunk of my income that they don't give me anything in return for. I'll consider keeping it if I can afford to, though. US tax liability.

- FBAR/FATCA requirements and penalties which reek of a presumption of guilt

- The increasing burden of tax reporting, which is preventing me from saving for retirement.

- Frustration/fed up with the nonsense

- Being forced to. I have dual citizenship and this actually reflects my feeling: connected to both my old and new country.

- The tax situation for expats (complicated filing requirements, draconian penalties if I make a mistake, possible financial impact on my non-US husband).

- Health care; safety

- Taxes

- Having to pay US taxes despite living abroad

- I guess the big thing is that I was brought up with a very patriotic set of beliefs. My father was a history professor, specializing in the American Revolution, and worked for the government during the Bicentennial. I was in the military (never saw any combat), and I believed in "America" (tm). But over the years, I've seen how the government no longer represents the people. It does what it wants to them, it unilaterally changes its agreement, and it ignores its own rules and laws. It's gotten to the point where I almost feel like a beaten wife. So it's time for me to leave.

- hard to say, tax bullshit, political bullshit, not identifying with the country

- So that my taxes would be paying for the United States' wars.

- Complexity of taxes once living abroad

- No need, no benefit, FATCA.

- The burdensome tax filing requirements. I don't mind having to file, but I mind that my tax filings are so much more complicated and prying than the filings my family in the States need to perform.

- Lack of desire to ever return or escalating political and economic issues in the US

- Ability to work in the EU. I can currently only work in the UK and the USA.

- In Switzerland, Americans are having their bank accounts taken away due to fatca. I am hoping my swiss passport will arrive before my banking options are limited.

- Job, marriage. Really just depends

- Onerous double-tax obligations and filing requirements, including stiff penalties for making minor, accidental clerical errors with no tangible benefits or representation to change the laws, and despite being middle-class, being treated and misrepresented as a fatcat trying to hide assets.

- It's fucking worthless.

- FATCA.

- Taxes, military obligation, politics

- To not have to pay taxes if I'm a permanent resident of another country.

- "Obtaining Taiwanese citizenship. No real benefits to US citizenship - only real reason to keep is for family ties (father still lives there)"

- Taxing abroad citizens, what's up with that?

- It no longer was necessary, or it did not provide any marked benefits to my life over my quality of life under a different citizenship. For example, if I decide to settle abroad permanently and I still had to pay high US taxes but received no benefit from it, other than a little less hassle going through airport security in the US, I would likely renounce my US citizenship. But if I were working for a US company or my future partner was American and our maintained American citizenship made life easier, I would keep it.

- Employment

- Taxes and regulations

- Having to pay double taxes or military draft. Otherwise would not give it up unless by some change in the rules forcing me to.

- Tax and reporting reasons

- To avoid paying US taxes when living abroad

- Taxes

- Better job opportunities.

- Taxes

- Better living, work conditions that make me happy

- Tempted to because of tax hassles, but holding on to for now in case I end up having to move there for a few years for work.

- Taxes

- N S A

- tax purposes

- Better quality of life, particularly universal healthcare.

- Healthcare

- Taxes

- Taxes

- Taxes

- Tax implications

- foreign or domestic policy

- Filing taxes and declaration of savings. I also feel no sense of loyalty or patriotism to the US. Partially because I was born in Australia and partially because I disagree with certain aspects of the American psyche.

- better quality of life -- health insurance, benefits, marriage, etc.

- The income tax BS.

- Be done with highly complex tax filing obligations.

- The politics and how America is fast becoming a police state.

- If I had to end up paying US taxes even though I'm not living in the US.

- FATCA

- The US scares me.

- The paperwork is really a burden. Also tons of countries like cambodia or vietnam have a special tax on visiting americans, which is lame. Also I'm disappointed by being disenfranchised by the voter registration rules particularly those of california and colorado.

- Do not wish to support war, want to escape the inevitable decline, want to be free of tedious reporting obligations.

- Becoming the most worldly possible. Also to not be 'american'

- Because it is becoming tougher and tougher being financially involved in the local economy as an american citizen.

- Easier to stay in EU

- Do not want children to be U.S. citizens.

- I haven't done it, yet, but it's on my mind, and if I do, it's not because of taxes, but because of banking and investment restrictions placed on me at home, in France, because I am a US citizen and in the US because I live in France.

- The right wing crazies trying to run the country and guns

- Unfair double taxation

- Stupid taxation-without-representation system that treats us like plutocrat money-laundering criminals and gives us anything in return

- If it would really give me much better benefits in the country I'm living in. Also, that I'm 100% comfortable in that country.

- To escape tax liability.

- Taxes/banking/ability to invest

- taxes

- It was worthless.

- My husband is the primary wage earner in our family and he is German. Germany would provide me with a better safety net for myself and our children if something should happen to him.

- Expenses and complications tied to US tax and banking declarations when I haven't even lived in the US since 1996. Note: I am single, not wealthy and I own no property, but this obligation is a nightmare for many Americans abroad who have lived and worked in a variety of countries, changing banks along with way. Trying to find a qualified accountant (who is knowledgeable about US and French/international filing) AND who accepts to take an average American as a client has become a challenge. They are all busy with their much wealthier clients who need more of their services and thus bring in more money. What's more, trying to get the information from my banks to declare the highest balance per year in all my bank accounts for the past five years involves contacting banks in other countries where I have worked and hope they reply (several of these accounts were closed years ago, but I still need to declare them) is a time-consuming hassle. As I no longer have accounts at their bank, I'm not even sure if they will reply, but I've been told that I cannot simply declare the highest amount on my monthly bank statement for the year, because within that month there is movement. Therefore, the banks all have to supply an official document stating what my balance was. You can imagine that most foreign banks are not anxious to welcome Americans with that kind of extra work. I'll stop there, but you get the picture.

- i am Canadian by birth, and American by association through my late father. I have never really felt American, and now I'm not too happy about what i was given. Based on the financial burden placed upon my family, i would say that would be the prime reason.

- Taxes, regulation, gain more freedom

- US tax policy, Disgusted and ashamed by US government and US politics

- Taxes or conscription to a war that I don't agree with.

- Taxes

- Burdensome financial reporting and double-taxation.

- oppessive undemocratic bullying.

- Taking on Canadian citizenship with intent to relinquish US citizenship

- The expense of filing tax forms to the IRS even though I have owed nothing to USA for 28 years. Also there are some cases of double taxation even though USA and Canada have a tax treaty -- they cannot fix all the loopholes. USA should get rid of citizenship based taxation.

- Better healthcare, safer society, less disastrous sociopolitical policies. "Depends on where and what I do next.

- Tax policy

- Tax complications, shame.

- Taxes

- Tax crap even though I barely get by on my paycheck, the absurd costs to do my taxes is unjustifiable and the citizenship status I would receive here is better that the US.

No comments:

Post a Comment